Restructuring and bankruptcy proceedings in May 2023

After the first quarter of this year, the economic situation remains stable, although the mood is not optimistic. In May, inflation was still well above target and the economy slowed. However, the analysis of data published in the National Debt Register shows that there have been no significant changes in the area of corporate insolvency.

Again, we analyzed the same variables:

- number of applications to initiate court restructuring proceedings and the number of announcements on setting the arrangement date in the arrangement approval procedure (PZU),

- the number of open court restructuring proceedings,

- the number of applications for bankruptcy and the number of declared bankruptcies,

- the difference between the statistics for the first five months of the current year in terms of the analyzed data.

Restructuring proceedings

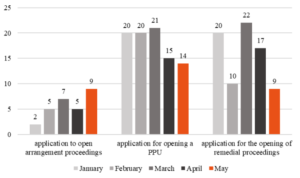

In May 2023, it was announced that 32 applications for opening court restructuring proceedings had been received. This is the lowest result this year. In relation to other past months, this is a decrease in the number of applications by 13.5% compared to April (37 applications), by 36% compared to March (50 applications), by 9% compared to February (35 applications) and by 24% compared to January.

By carefully analyzing the data on the number of applications for opening particular types of restructuring proceedings, certain observations can be made. First of all, there was an increase in interest in arrangement proceedings, which for the first time this year equaled the popularity of sanation proceedings. Secondly, the previously drawn conclusions about the sinusoidal interest in opening remedial proceedings should be upheld. Thirdly, the decline in the popularity of accelerated arrangement proceedings, visible since April, has continued.

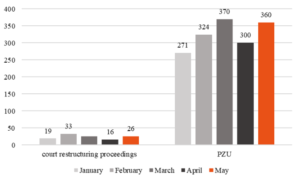

Chart 1. Number of applications to initiate court restructuring proceedings submitted in the first five months of 2023.

Source: Own elaboration based on data collected from KRZ.

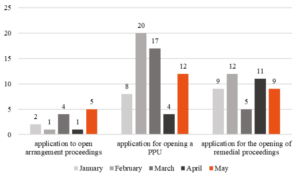

Last month, 26 court restructuring proceedings were opened. Compared to the data from previous months, it is the same as in March, less than in February (by 21%), but more than in April (by 37.5%) and January (by 63%).

PPU (12) accounted for the largest number of open restructuring proceedings in May, followed by sanation proceedings (9) and then arrangement proceedings (5). It seems, therefore, that there has been a return to the trend observed in the first quarter and disturbed in April in the number of openings of particular types of restructuring. It should be noted, however, that although there is an increase in the number of PPUs opened, large fluctuations in the number of proceedings of this type opened over the past months have also been visible. On the other hand, the number of opened remedial and composition proceedings remains at a similar level.

Chart 2. Number of court restructuring proceedings opened in the first five months of 2023.

Source: Own elaboration based on data collected from KRZ.

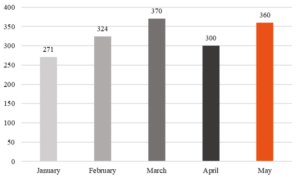

In May, 360 debtors decided to announce the arrangement date1. This is more than in April (20%), February (11%) and January (33%) and slightly less than in March (3%), when the largest number of proceedings for approval of the arrangement was opened this year (PZU ). It seems that the upward trend observed in the first quarter, which collapsed in April, will now steadily increase.

Chart 3. Number of PZU openings in the first five months of 2023.

Source: Own elaboration based on data collected from KRZ.

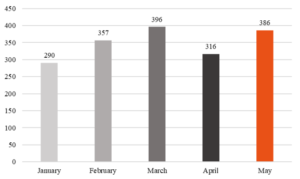

In total, 386 restructuring proceedings were opened in May. This is the second highest result this year. It is only 2.5% less openings than in March, when the most restructuring was initiated in 2023. Comparing the data for May with the remaining previous months, an increase of 22% in comparison with April, 8% in comparison with February and 33% in comparison with January can be noted2.

Chart 4. Number of opened restructuring proceedings in the first five months of 2023.

Source: Own elaboration based on data collected from KRZ.

Out of all restructuring proceedings, 26 were opened by the court and 360 by PZU. This is 7% and 93% respectively. Comparing the data for May with the data from the remaining five months of this year, it can be seen that the numbers showing the opening of court restructurings remain at a similar level. On the other hand, PZU’s interest, which was shaken last month, is increasing.

Chart 5. Number of court and out-of-court restructuring proceedings opened in the first five months of 2023.

Source: Own elaboration based on data collected from KRZ.

Bankruptcy proceedings

In May, 1,952 applications for bankruptcy were filed with the restructuring and bankruptcy courts. And although this is the second highest result this year, it should be emphasized that it is as much as 18% lower than the highest number of applications (2381) submitted in March 2023. Comparing the data for May to other months, relatively small increases are observed: by 2% of the number of applications compared to April and February (1918 and 1909 applications) and by 10% compared to January (1776 applications).

Looking at the detailed figures, it can be seen that out of 1,952 applications, only 113 concerned commercial companies and 1,839 natural persons3. This is 6% and 94% respectively. Looking at the detailed data on commercial law companies, it is noticed that they are virtually identical to those recorded in April. With regard to the remaining months, there was an 8% and as much as 29% decrease in the number of applications submitted in February (123 applications) and March (159 applications), respectively, and a 24% increase in the number of applications registered in January (91 applications). However, the analysis of detailed data on natural persons shows that there was only a 2%, 3% and 9% increase in the number of bankruptcy applications compared to the data for April, February and January, and as much as 17% decrease compared to the data for March.

Chart 6. Number of bankruptcy filings filed in the first five months of 2023.

Source: Own elaboration based on data collected from KRZ.

In May 2023, the courts issued 1,852 bankruptcy orders. This is the second highest result this year, 10% lower than the highest, so far, number of resolutions that were issued in March (2060). Compared to the rest of the analyzed period, it is 21%, 5% and 12% more resolutions than in April (1536), February (1770) and January (1649), respectively.

Out of 1,852 provisions, 24 concerned commercial law companies and 1,828 natural persons. This is 1% and 99% respectively. A detailed analysis of the data on bankruptcy declarations of companies shows that the figures in this regard have remained at a similar level over the past five months. In turn, in the case of bankruptcy decisions for natural persons, there was an increase of 21% compared to April, 5% compared to February, 12% compared to January and a 10% decrease compared to March.

Chart 7. Number of bankruptcy decisions issued in the first five months of 2023.

Source: Own elaboration based on data collected from KRZ.

Summary

The above analysis of data showing the restructuring and bankruptcy proceedings in May 2023 leads to the following conclusions. In the analyzed period, 32 applications for opening court restructuring were submitted. This represents 16% of all applications submitted in these cases over the past five months. A downward trend in this aspect has been visible for two months. It is also shared by the decline in interest in PPU, which was very popular at the beginning of the year. On the other hand, with regard to the number of applications for the initiation of arrangement proceedings and remedial proceedings, large fluctuations of interest are constantly visible. In turn, with regard to the opening of court restructuring proceedings, 26 of them were recorded in May. This constitutes 22% of all restructurings opened from January to May and remains at a relatively similar and stable level (differences range from a few to a dozen applications). The same can be said in the context of the opening of composition and sanation proceedings. However, it is different in the case of initiating PPU. The fluctuations observed here are significant. On the other hand, in relation to PZU, a renewed increase in interest was observed. In May, 360 debtors opted for this type of restructuring procedure, which constitutes 22% of all announcements on the arrangement date made this year. Therefore, the statement that PZU continues to have a definite advantage in popularity remains valid. In the past five months, a total of 1,745 restructuring proceedings were opened, including 120 by court decision and 1,625 by announcement of the arrangement date in PZU. This is 7% and 93% respectively.

With regard to bankruptcy proceedings, there was an increase oscillating between a few and a dozen or so percent in relation to the number of bankruptcy applications (by 2% compared to April and February and by 10% compared to January) and the number of declared bankruptcies (by 21%, 5% and 12% more than April, February and January). This allows us to conclude that in both aspects the level of applications submitted and decisions issued remains at a relatively similar level. However, it cannot be overlooked that in March there was a sharp increase in the indicated numbers and then exceeded the threshold of 2,000 both applications and bankruptcy decisions. In terms of detailed data on applications and decisions issued against commercial law companies and natural persons, the same trend is invariably visible, namely the previous data remains at a similar level. And in this respect, the above-mentioned trend was disrupted in March.

In conclusion, the conclusions made in the previous report should be corrected. Well, then it seemed that in April there were drops in virtually every analyzed category of data. Now, however, taking into account the data from May and looking holistically at the period analyzed so far, it should be stated that March was particularly outstanding in each category subject to the study. Taking this into account, it should be stated that the data from the past months actually oscillate at similar levels.

The study was prepared by: Ph.D Ulyana Zaremba and Ph.D Maria Wąsicka-Sroczyńska and and Legal Counsel Maciej Woźniak.

1 As in previous reports, we would like to remind you that the indicated number does not reflect all commenced proceedings for approval of the arrangement, but only those in which the debtor decided to take advantage of the protection provided by the notice in the KRZ.

2 Data from January 2023 to which we refer are available at the following link: https://orestrukturyzacji.pl/en/2023/02/28/restructuring-and-bankruptcy-proceedings-in-january-2023/, data from February 2023: https://orestrukturyzacji.pl/en/2023/03/24/restructuring-and-bankruptcy-proceedings-in-february-2023/, data from March 2023: https://orestrukturyzacji.pl/en/2023/04/21/restructuring-and-bankruptcy-proceedings-in-march-2023-with-a-quarterly-summary/, data from April 2023: https://ostruktur.pl/2023/05/29/ restructuring-and-bankruptcy-proceedings-in-April-2023/.

3 By natural persons, we invariably mean both applications submitted by consumers and and by business owners.