Restructuring and bankruptcy proceedings in September 2023 with quarterly summary

Our website team analyzed what the numbers told us about the situation of insolvent entrepreneurs in September this year. The picture of restructuring and bankruptcy proceedings at this time indicates that the current regularities will be maintained. We can also talk about a certain regularity of phenomena in the first three quarters of this year.

The set of analyzed data has not changed. So we looked at:

- the number of applications to initiate court restructuring proceedings and the number of announcements on setting the arrangement day in the arrangement approval proceedings (PZU),

- the number of open court restructuring proceedings,

- the number of bankruptcy applications and the number of declared bankruptcies,

- the difference between the statistics for the past three quarters of the current year in terms of the analyzed data.

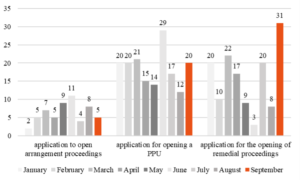

Restructuring proceedings

In September 2023, the receipt of 56 applications for the opening of court restructuring proceedings was announced. This is the largest number of applications of this type submitted this year. This is largely the result of significant interest in restructuring proceedings. In September, 31 restructuring applications were submitted, which constitutes 55.4% of all submitted applications. This was followed by the popularity of accelerated arrangement proceedings (PPU), which was requested by 20 people (36% of the total) and arrangement proceedings – 5 applications (9% of the total). This means that the observed fluctuations in interest in these types of restructuring remain at a similar level.

However, over the past nine months of this year, 364 applications for opening court restructuring proceedings were submitted, of which 127 in the first quarter, 112 in the second quarter and 125 in the third quarter. This represents 35%, 31% and 34% of all submitted applications, respectively, and leads to the conclusion that interest in court proceedings remains at a similar level. In turn, delving into the detailed data illustrating the popularity of individual types of restructuring, the dominance of PPU (168 applications representing 46.2%) and restructuring (140 applications representing 38.5%) over arrangement proceedings (56 applications representing 15.4%) is clearly visible.

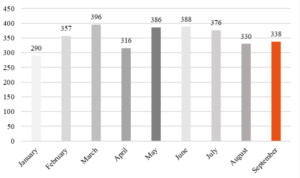

Chart 1. Number of applications submitted to initiate court restructuring proceedings in the third quarter of 2023.

Source: Own study based on data collected from KRZ.

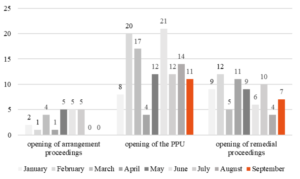

In September, 18 court restructuring proceedings were opened. This number included 11 PPUs (61% of the total) and 7 sanations (39% of the total). Once again (this situation occurred in August), the courts did not initiate any arrangement proceedings. Therefore, the current trend of a small number of arrangement proceedings being opened is slowly becoming obsolete. However, the remaining theses about the observed fluctuations in the number of PPUs opened and restructuring proceedings may still be upheld. Moreover, it is increasingly clear that the above-mentioned fluctuations oscillate within certain narrow limits.

However, over the past nine months of this year, 215 court restructuring proceedings were opened, of which 78 in the first quarter, 74 in the second quarter and 63 in the third quarter. This represents, respectively, 36%, 34% and 29% of all initiated court restructurings. This allows us to conclude that in the past quarters the courts issued a comparable number of decisions on opening restructuring proceedings. However, when delving into the detailed data showing the opening of particular types of restructuring, the dominance of PPU (119 applications constitutes 55%) is undeniable. Next, restructuring proceedings were initiated (73 applications representing 43%), and arrangement proceedings constituted the smallest percentage of openings (23 applications representing 10.7%).

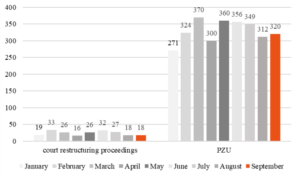

Chart 2. Number of open court restructuring proceedings in the third quarter of 2023.

Source: Own study based on data collected from KRZ.

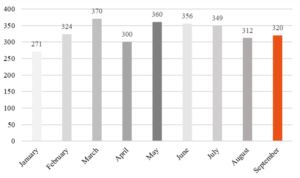

The procedure for approval of the arrangement (PZU) is still very popular. In September, 320 debtors announced the establishment of an arrangement day1. This is 13.5% less than in March2, when the largest number of arrangement days in PZU was announced, and 18% more than in January, when the least number of arrangement days were announced in PZU.

During the past nine months of this year, 2,962 arrangement days were announced at PZU, of which 965 in the first quarter, 1,016 in the second quarter and 981 in the third quarter. This amounts to 33%, 34% and 33% respectively. On this basis, it can be concluded that the popularity of PZU remains unchanged, and the average number of announcements is 329.

Chart 3. Number of PZUs opened in the third quarter of 2023.

Source: Own study based on data collected from KRZ.

A total of 338 restructuring proceedings were opened in September. Compared to March (when the most restructuring proceedings were opened), it is a decrease of 14.5%, and compared to January3 (the least restructuring proceedings were opened then), an increase of 16.5%.

In the past nine months of 2023, 3,177 restructuring proceedings were opened. Of these, 1,043 in the first quarter, 1,090 in the second quarter and 1,044 in the third quarter. This represents, respectively, 33%, 34% and 33% of all initiated restructurings. This supports the conclusion that the number of initiated restructurings is evenly distributed and shows that the average number of all open restructuring proceedings is 353.

Chart 4. Number of open restructuring proceedings in the third quarter of 2023.

Source: Own study based on data collected from KRZ.

In September, of all restructuring proceedings, 18 were opened by the court, and 320 were PZU. This represents 5% and 95% respectively. However, over the last three quarters, 215 court restructurings and 2,962 PZUs were opened, which corresponds to 7% and 93%.

Chart 5. Number of open judicial and out-of-court restructuring proceedings in the third quarter of 2023.

Source: Own study based on data collected from KRZ.

Bankruptcy proceedings

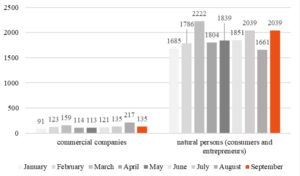

In September 2023, restructuring and bankruptcy courts received 2,174 applications from debtors to declare bankruptcy. This is the second highest result this year (the same number of applications were received in July), 18% lower than the highest number of applications (2,381) submitted in March and 22% higher than the lowest number of applications submitted (1,776) in January.

In turn, of all applications submitted in September (2,174): 135 concerned commercial law companies and 2,039 related to natural persons (an identical number of applications from these two categories of entities was received in July)4. This represents 6% and 94% respectively. Therefore, in both analyzed issues, these numbers are at the forefront. Applications submitted in September (135) by commercial law companies are the third highest result, after the data for August (217 applications) and March (159 applications). However, the number of applications (2,039) submitted by natural persons is the second highest result (8% more applications were submitted in March).

Over the past three quarters, 18,134 bankruptcy applications were filed. Of these, 6,066 in the first quarter, 5,842 in the second quarter and 6,226 in the third quarter. This accounts for 34%, 32% and 34% of all applications, respectively, and allows for conclusions to be at a certain stabilized level. When analyzing in detail the data regarding commercial law companies and natural persons, it was noticed that 1,208 commercial law companies filed for bankruptcy (373 in the first quarter, 348 in the second quarter and 487 in the third quarter) and 16,926 natural persons (5,693 in the first quarter, 5,494 in the second quarter and 5,739 in the third quarter), which constitutes 7% and 93% of the total. These numerical and percentage ranges are extremely stark, but not surprising. We have been observing them constantly since the beginning of the year.

Chart 6. Number of bankruptcy applications filed in the third quarter of 2023.

Source: Own study based on data collected from KRZ.

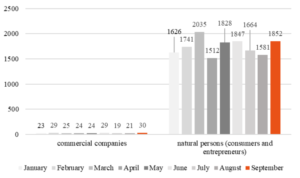

In September 2023, courts issued 1,882 decisions declaring bankruptcy. Therefore, this is the second highest result this year, 9% lower than the highest number of applications (2,060) submitted in March and 17.5% higher than the lowest number of applications submitted (1,602) in August.

Of all these decisions issued in September: 30 concerned commercial companies and 1,852 to natural persons. This represents 2% and 98% respectively. The number of decisions issued regarding company bankruptcy (30) is the highest this year. In turn, the number of decisions regarding natural persons (1,852) is the second highest result this year (1.6% more applications were submitted in March).

However, over the past quarters, 15,910 decisions declaring bankruptcy were issued, including 5,479 in the first quarter, 5,264 in the second quarter and 5,167 in the third quarter. This represents 34%, 33% and 33% of all provisions, respectively. Excluding detailed data on commercial law companies and natural persons, there were 224 decisions declaring bankruptcy of commercial law companies (77 in the first quarter, 77 in the second quarter and 70 in the third quarter) and 15,686 decisions regarding the bankruptcy of natural persons (5,402 in the third quarter). Q1, 5,187 in Q2 and 5,097 in Q3), representing 1% and 99% of the total. And also with regard to these data, it can be clearly stated that the numerical and percentage discrepancies have been constantly widening since the beginning of the year.

Chart 7. Number of decisions declaring bankruptcy issued in the third quarter of 2023.

Source: Own study based on data collected from KRZ.

Summary

The analysis of the collected data for September illustrating restructuring proceedings allows us to conclude that apart from the highest number of applications for opening restructuring, no other deviations were noticed this month. On the contrary. The current status quo has been maintained, which is guaranteed by: the number of applications for opening restructuring proceedings and the number of initiated restructurings, along with detailed numbers reflecting the level of interest and opening of specific types of restructuring, as well as numbers proving the popularity of PZU. All this data confirms some fluctuations within each analyzed category, but they are within the limits of the norm that has been noticed so far. Thus, in the past nine months, a total of 3,177 restructuring proceedings were opened, including 215 by court decision and 2,962 by announcement of the arrangement date in PZU. This represents 7% and 93%, respectively, and undeniably confirms PZU’s continued and clear popularity among selected proceedings. In turn, PPU clearly dominates among court restructurings.

With regard to bankruptcy proceedings, September dominated both in terms of the total number of applications and announced bankruptcies. In both analyzed categories, the data for September is considered one of the highest, being 8% and 9% less, respectively, than in March, when the largest number of applications and resolutions were recorded. The situation is similar in terms of detailed data showing the number of applications and decisions declaring bankruptcy by commercial companies and individuals. And in these cases, the data for September is at the forefront. However, referring to data for three quarters, bankruptcy was filed 18,134 times and it was announced 15,910 times. Delving into the detailed data, the disproportion between applications and resolutions regarding the bankruptcy of commercial companies and natural persons becomes more and more visible. Conclusions and decisions in this case regarding companies constitute 7% and 1%, respectively, and regarding consumers 93% and 99%.

The study was prepared by: Ph.D Ulyana Zaremba and Ph.D Maria Wąsicka-Sroczyńska and and Legal Counsel Maciej Woźniak.

1 Similarly to previous reports, we would like to remind you that the indicated number does not reflect all initiated proceedings for the approval of an arrangement, but only those in which the debtor decided to use the protection provided by the announcement in the KRZ.

2 In the report “Restructuring and bankruptcy proceedings in May 2023” we pointed out that the March data were particularly outstanding in each category examined.

3 The data from January 2023 to which we refer are available at the link: https://orestrukturyzacji.pl/en/2023/02/28/restructuring-and-bankruptcy-proceedings-in-january-2023/ and the data from February 2023: https://orestrukturyzacji.pl/en/2023/03/24/restructuring-and-bankruptcy-proceedings-in-february-2023/ and the data from March: https://orestrukturyzacji.pl/en/2023/04/21/restructuring-and-bankruptcy-proceedings-in-march-2023-with-a-quarterly-summary/ and the data from April: https://orestrukturyzacji.pl/en/2023/05/29/restructuring-and-bankruptcy-proceedings-in-april-2023-2/ and the data from May: https://orestrukturyzacji.pl/en/2023/06/19/restructuring-and-bankruptcy-proceedings-in-may-2023-2/ and data from June, July and August: https://orestrukturyzacji.pl/en/2023/10/10/restructuring-and-bankruptcy-proceedings-in-june-july-and-august-2023-2/.

4 By natural persons we invariably mean both applications submitted by consumers and and by entrepreneurs running a business.