Restructuring and bankruptcy proceedings in February 2023

Observing the dynamics of changes in the scope of restructuring proceedings and bankruptcy, we analyzed the announcements published in the National Register of Indebtedness (KRZ) in February 2023.

In particular, we looked at:

- the number of applications to initiate court restructuring proceedings and the number of announcements on setting the arrangement date in out-of-court arrangement approval proceedings (PZU)1,

- the number of open court restructuring proceedings,

- the number of applications for bankruptcy and the number of declared bankruptcies,

- the difference between the statistics for January and February in terms of the analyzed data.

Restructuring proceedings

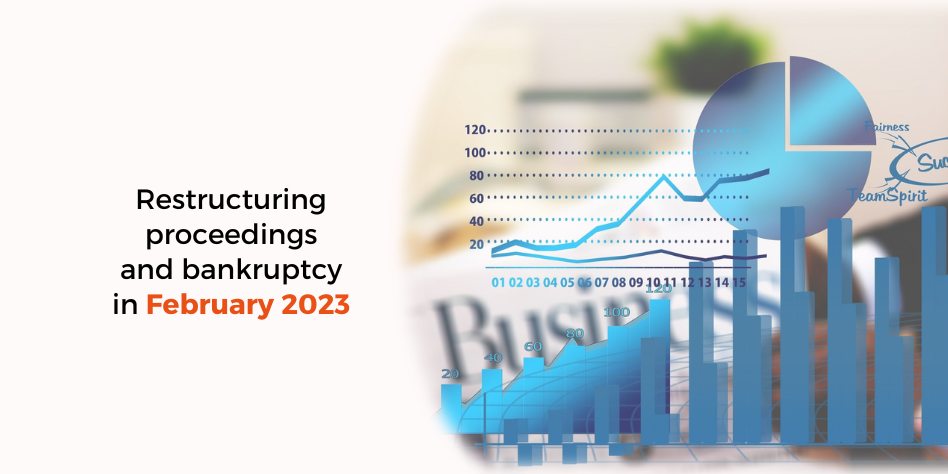

In February this year, it was announced that 35 applications for opening court restructuring proceedings had been received. This is 20% less compared to January2.

Comparing the data on individual types of restructuring, it can be seen that the interest in accelerated arrangement proceedings (PPU) has remained unchanged. In February, as in January, 20 applications for its opening were received. On the other hand, the number of applications for opening arrangement proceedings increased and it decreased twice in the case of rehabilitation.

Chart 1. Number of applications to initiate court restructuring proceedings submitted in January and February 2023.

Source: Own elaboration based on data collected from KRZ.

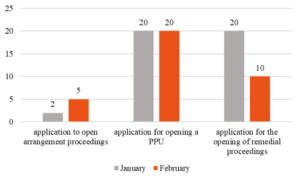

In the audited period, 33 court restructuring proceedings were opened, of which: 20 were accelerated arrangement proceedings (PPU), 12 sanation proceedings and 1 arrangement proceedings. Compared to January, there was a 60% increase in open PPU, a 25% increase in sanation proceedings and a 50% decrease in arrangement proceedings.

Chart 2. Number of court restructuring proceedings opened in January 2023.

Source: Own elaboration based on data collected from KRZ.

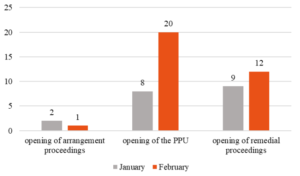

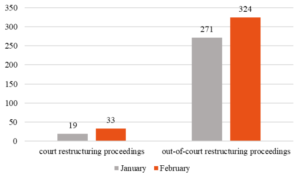

Proceedings for approval of the arrangement (PZU), which is commonly referred to as “out-of-court” restructuring proceedings, enjoyed the greatest interest. Last month, as many as 324 debtors made an announcement about setting the arrangement date3. This is 16% more than last month and confirms that PZU continues to be the most frequently chosen type of restructuring.

Chart 3. Number of out-of-court restructuring proceedings opened in January and February 2023.

Source: Own elaboration based on data collected from KRZ.

The number of announcements regarding the arrangement day was record-breaking. The highest result so far in a calendar month was in November 2022 and amounted to 274. Announcements in February 2023 also differ significantly from the average for the previous 6 months (August-January), amounting to 250.5. In this context, it is worth noting that the result concerns February, which is the shortest month of the year.

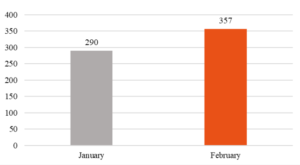

In total, 357 restructuring proceedings were opened in February. Compared to January, an increase of 23% was observed.

Chart 4. Number of opened restructuring proceedings in January and February 2023.

Source: Own elaboration based on data collected from KRZ.

Out of all restructuring proceedings opened in February, 33 were court cases and 324 were extrajudicial. This is 9.2% and 90.8%, respectively. Compared to January, there was an increased number of both court (19 opened in January) and out-of-court (271 opened in January) restructuring proceedings. This increase was estimated at 43% and 16%, respectively.

Chart 5. Number of court and out-of-court restructuring proceedings opened in January and February 2023.

Source: Own elaboration based on data collected from KRZ.

Bankruptcy proceedings

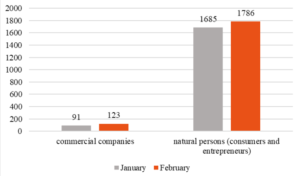

1,909 debtors’ bankruptcy petitions were filed with restructuring and bankruptcy courts in February. Of these, 123 concerned commercial law companies, and 1786 natural persons4. This is 6.4% and 93.6%, respectively. Comparing these data with the data for January, an increase of 7% in the total number of bankruptcy applications, 26% of applications for commercial law companies and 6% of applications filed by natural persons can be seen.

Chart 6. Number of bankruptcy filings filed in January and February 2023.

Source: Own elaboration based on data collected from KRZ.

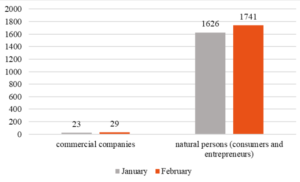

Last month, the courts issued 1,770 bankruptcy decisions. Of these, 29 decisions on commercial law companies and 1,741 decisions on natural persons. This is 1.6% and 98.4%, respectively. Compared to the data for January, there was an increase in each of the analyzed aspects by: 7% of all bankruptcy decisions, 20.7% of bankruptcy decisions for commercial law companies and 6.9% of natural persons bankruptcy decisions.

Chart 7. Number of bankruptcy decisions issued in January and February 2023.

Source: Own elaboration based on data collected from KRZ.

Summary

The data quoted above lead to several conclusions. First of all, compared to January, February saw a 26% increase in the number of restructuring proceedings opened. PZU continued to be the most attractive procedure among entities experiencing financial difficulties. This is certainly the result of the advantages attributed to PZU. What’s more, in the following months, the currently observed 16% increase may clearly progress. There are no symptoms that would indicate that this restructuring formula has been exhausted. However, the conclusion drawn from the statistics for January regarding the increase in the popularity of court restructuring requires a partial revision. Well, in February, 20% less applications were submitted in this regard. It is therefore necessary to observe whether this is an isolated case or whether this trend will continue in the future. At the same time, in February the number of open court restructurings increased by almost 43%. PPU and remedial proceedings still dominate among this type of restructuring.

On the other hand, in the case of bankruptcy proceedings, a 7% increase was recorded in both the number of bankruptcy applications and the number of declared bankruptcies. This seems to confirm the forecasts from the beginning of the year, according to which the number of bankruptcies will systematically increase.

The study was prepared by: Ph.D Ulyana Zaremba and Ph.D Maria Wąsicka-Sroczyńska and and Legal Counsel Maciej Woźniak.

1 Proceedings for approval of the arrangement are not fully out-of-court proceedings – it is necessary to issue a court order to approve the arrangement. As for the possibility of introducing into the national legal order proceedings taking place completely without the participation of a court, see: A. J. Witosz, D. Benduch, Restructuring out of court, RPEiS 1/2022, available. https://pressto.amu.edu.pl/index.php/rpeis/article/download/29117/28208/

2 Data from January 2023 to which we refer are available at the following link: https://orestrukturyzacji.pl/en/2023/02/28/restructuring-and-bankruptcy-proceedings-in-january-2023/

3 Just like last month, we would like to remind you that the indicated number does not reflect all commenced proceedings for approval of the arrangement, but only those in which the debtor decided to take advantage of the protection provided by the announcement in KRZ.

4 By natural persons, we invariably mean both applications submitted by consumers and and by business owners.