Non-interest costs of a consumer loan in the pandemic era

The Act of 12 May 2011 on consumer credit defines the permissible amount of non-interest consumer costs equal to the sum of 25% of the total loan amount and 30% of the total loan amount on an annual basis. These values were for lending entities before the coronavirus day.

In connection with the emergence of the COVID-19 pandemic, the legislator introduced the Act of March 2, 2020 on special solutions related to the prevention, prevention and combating of COVID-19, other infectious diseases and the crisis situations caused by them, introducing new, reduced limits on non-seed costs of consumer credit .

For loans with a repayment period of not less than 30 days, reduced rates were introduced at the level equal to the sum of 15% of the total loan amount and 6% of the total loan amount on an annual basis.

In the case of loans granted with a repayment period of less than 30 days, the so-called payday loans the maximum amount of non-interest consumer loan costs decreased by 5% of the total loan amount.

The Act also stipulated that non-interest costs of a consumer loan may not exceed 45% of the total loan amount.

Due to the introduction of the above-mentioned legislative changes, some loan companies were unable to conduct their operating activities in a profitable manner. The loan company market saw a significant decline in the value of the financing provided during the pandemic. Loan entities had a problem in creating appropriate offers guaranteeing them a profitable source of income based on the new regulations. At the same time, having obligations towards, inter alia, bondholders, decline in investor confidence and the possibility of obtaining financing, many loan institutions in Poland have reduced their activity on the market or ceased their activities.

As of July 1, 2021, the maximum non-interest costs returned to higher levels prior to the introduction of the COVID-19 law. However, this does not mean an immediate improvement in the financial situation of loan companies. Consumers may be even more discouraged from borrowing money that becomes more expensive. First of all, the problems of the industry are caused not only by legislative changes, but by the wider crisis related to the lending environment.

Loan companies that are struggling to stay in business or having problems with insolvency can benefit from a restructuring process that will help them avoid filing for bankruptcy. Looking at the consequences of the changes introduced in the act on the maximum non-interest cost, a decrease in consumer creditworthiness and a decrease in the value of financing provided, the loan industry is facing a period of changes and reorganization of operations. In the near future, an increasing number of restructuring and bankruptcies of loan companies is possible. Restructuring proceedings will play a significant role in maintaining the activity related to granting non-bank loans on the market.

According to data from reports published by Zimmerman Filipiak Restrukturyzacja S.A. the outbreak of the pandemic resulted in a significant increase in the number of restructurings in the financial business sector, to which lending companies belong. The third quarter was characterized by a large increase in the number of proceedings in the industry. On the other hand, the most restructuring in the last 12 months was recorded in the last quarter of 2020. In this case, the number of opened restructuring proceedings was the highest compared to the previous 12 months and amounted to 19.

Table 1. Number of restructurings for the last 12 months in the financial activity sector (PKD 64).

| Period | 2020Q1 | 2020Q2 | 2020Q3 | 2020Q4 |

| Number | 3 | 5 | 13 | 19 |

Source: own study based on the reports “Restructuring in Poland” Zimmerman Filipiak Restrukturyzacja.

Table 2. Percentage difference in the number of open restructuring proceedings in the last 12 months compared to the previous 12 months in the financial activity sector (PKD 64).

| 01..20 | 02.20 | 03.20 | 04.20 | 05.20 | 06.20 | 07.20 | 08.20 | 09.20 | 10.20 | 11.20 | 12.20 |

| -20% | -50% | -67% | -67% | -50% | 25% | 200% | 120% | 333% | 275% | 375% | 375% |

Source: own study based on the reports “Restructuring in Poland” Zimmerman Filipiak Restrukturyzacja.

According to CRIF data, in August 2020 the number of active loan companies (i.e. those that granted at least one loan) was 36. This means a decrease in the number of Polish loan entities by 28% in terms of market activity compared to the previous year.

Table 3. Number of active loan companies in a given month.

| 08.19 | 07.20 | 08.20 |

| 50 | 35 | 36 |

Source: own study based on data from the CRIF.

According to the data of the Credit Information Bureau (hereinafter: BIK), the number of non-bank loans granted in September 2021 amounted to over 275 thousand. pieces. This is an increase of 70.7% compared to September 2020. Looking at the period from the beginning of this year to September, the total sale of loans amounted to over 2,125,000. pieces. This means an increase by 46.7% in the number of loans granted compared to the same period in 2020.

Chart 1. Number of non-bank loans (in thousands) and dynamics (y / y in%).

Source: own study based on data from BIK.

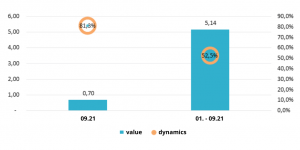

BIK data also indicate a significant increase in the value of loans granted in 2021. The value of loans sold in September 2021 was PLN 0.7 billion. This result is 81.3% higher than in September 2020. From January to September 2021, the total value of non-bank loans amounted to over PLN 5.1 billion. This is an amount higher by 52.5% compared to the corresponding period of 2020.

Chart 2. Value of non-bank loans (in PLN billion) and dynamics (y / y in%).

Source: own study based on data from BIK.

Looking at the current, this year’s results of the loan market compared to those achieved in 2020, a significant increase in the value of the portfolio and the number of loans granted is noticeable. Lenders recorded the largest increase in September 2021 in terms of loans in the following ranges:

- up to PLN 500 (138.1%),

- more than PLN 5,000 (89.8%).

It is the loans with a value above PLN 5,000 that in September constituted the largest share of loans granted (42.2%). However, in quantitative terms, the largest number of loans was granted up to PLN 1,000 (45.6%).

Data from BIK confirm the revival of the loan market after the COVID-19 pandemic and the lifting of the limiting limits on non-interest costs of credit. The situation in the industry is slowly returning to the levels achieved in the corresponding periods before the pandemic. Despite the fact that the activity of lending institutions is systematically increasing, it has still not been possible to return to the results achieved before the crisis related to the COVID-19 pandemic.

The loan industry will also face legislative changes in the near future. Currently, the government deals with the so-called anti-usury act. In mid-October, the Government’s Legislation Center published a tab on its website called “Draft Act Amending Certain Acts to Prevent Usury”. The loan market waits for the content of the above-mentioned bill and, above all, for its effects unknown to them. He is born, among others the question of what limit of non-interest costs is planned to be introduced by the government. The Ministry of Justice announced the possibility of returning to the lowered limits from the pandemic period, thus adversely affecting the situation of lenders. In subsequent statements by the legislator, the limits would be 10% of the total loan amount and 10% of the total loan amount on an annual basis. So far, none of the above values has been officially confirmed by the Ministry. In addition, the bill is to impose additional obligations on lenders, e.g. verification of clients’ income and expenses. In the case of non-existent, appropriate data verification, the effect would be, among others no possibility to sell such a claim.

The Polish Financial Supervision Authority would supervise the non-bank loan industry in terms of information requirements imposed on it. The data submitted by loan entities under the draft act are to include, among others non-interest loan status, number and value of loans, number of customers or non-interest income. Failure to comply with the requirements of the act is to be associated with a number of fees and penalties imposed on loan companies and key employees.

The activities related to the creation of the anti-usury act raise anxiety in the loan industry. The fear of the financial and legislative situation during the pandemic is justified due to the steps taken by the legislator towards the act. In addition, loan entities are not taken into account when creating the law that directly affects them. The Ministry, without consulting the introduced regulations, while secretly preparing an important document covering the loan sector, causes objections from the community of lending institutions, including the Polish Association of Loan Institutions.