Restructuring and bankruptcy proceedings in June, July and August 2023

The holiday period is a time of holidays and rest, which usually reduces the intensity of work in law firms and courts. This is visible in statistics, including those regarding bankruptcy and restructuring. This rule also applies to last summer, although – despite this – we cannot talk about a suspension of activity due to the insolvency of entrepreneurs and consumers.

In accordance with the adopted methodology, we analyzed the same variables:

- number of applications to initiate court restructuring proceedings and the number of announcements on setting the arrangement day in the arrangement approval proceedings (PZU),

- number of open court restructuring proceedings,

- the number of bankruptcy applications and the number of declared bankruptcies,

- the difference between the statistics for the first five months of the current year in terms of the data analyzed.

Restructuring proceedings

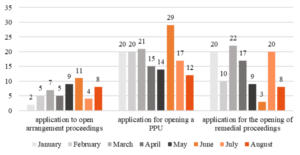

During the summer months (June, July, August), 112 applications for opening court restructuring proceedings were announced, of which 43 were in June, 41 in July, and 28 in August. These numbers in June and July were among the highest this year. Only in March more applications were submitted (50) than in June, and in January more (42) than in July. The situation was different in August. Well, compared to all the previous months, the fewest applications were submitted in August.

Both in the analyzed period and throughout the past eight months, large fluctuations (up to several dozen percent) were observed in the number of applications submitted under all available types of restructuring.

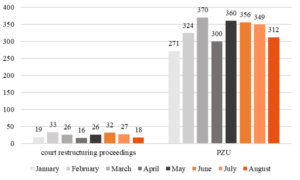

Chart 1. Number of applications to initiate court restructuring proceedings submitted in June, July and August 2023.

Source: Own study based on data collected from KRZ.

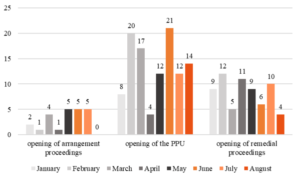

In the period under review, 77 court restructuring proceedings were opened, of which 32 in June, 27 in July and 18 in August. The vast majority (47) were PPUs, followed by restructuring proceedings (20) and then arrangement proceedings (10). When considering each of the available types of restructuring individually, it should be noted that there were clear fluctuations in their popularity throughout the analyzed period and throughout this year’s months. However, it should be noted that this applies primarily to PPU and restructuring, and to the least extent to arrangement proceedings.

Chart 2. Number of open court restructuring proceedings in June, July and August 2023.

Source: Own study based on data collected from KRZ.

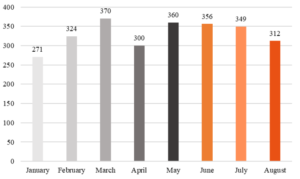

The procedure for approval of the arrangement (PZU) continues to enjoy great interest. Within three months (June, July and August), 1,017 debtors announced the arrangement date1.

Chart 3. Number of open PZUs in June, July and August 2023.

Source: Own study based on data collected from KRZ.

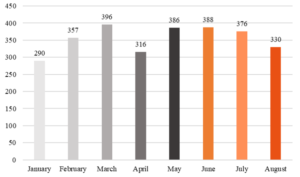

During the three summer months, a total of 1,094 restructuring proceedings were opened2.

Chart 4. Number of open restructuring proceedings in June, July and August 2023.

Source: Own study based on data collected from KRZ.

Of all restructuring proceedings, 77 were opened by the court (32 in June, 27 in July and 18 in August), and 1,017 were PZU cases (356 in June, 349 in July and 312 in August). This represents 7% and 93% respectively.

Chart 5. Number of open judicial and out-of-court restructuring proceedings in June, July and August 2023.

Source: Own study based on data collected from KRZ.

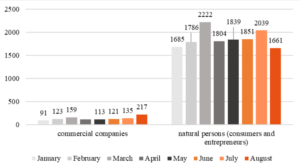

Bankruptcy proceedings

During the holiday period (June, July, August) of 2023, restructuring and bankruptcy courts received 6,024 applications from debtors to declare bankruptcy (1,972 in June, 2,174 in July, and 1,878 in August). Of these, 473 concerned commercial law companies and were distributed as follows: 121 in June, 135 in July, 217 in August). In turn, 5,551 concerned natural persons, of which: 1,851 in June, 2,039 in July, 1,661 in August3 . This represents 8% and 92% respectively.

Chart 6. Number of bankruptcy applications submitted in June, July and August 2023.

Source: Own study based on data collected from KRZ.

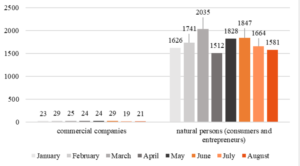

During the holiday season of 2023, courts issued 5,161 decisions declaring bankruptcy. Of these, 69 resolutions concerned commercial companies (29 in June, 19 in July, 21 in August) and 5,092 to natural persons (1,847 in June, 1,664 in July and 1,581 in August). This represents 1% and 99% respectively.

Chart 7. Number of decisions declaring bankruptcy issued in June, July and August 2023.

Source: Own study based on data collected from KRZ.

Summary

During the analyzed three months, a total of 1,094 restructuring proceedings were opened, including 77 by court decision and 1,017 by announcement of the arrangement date in PZU. This represents 7% and 93% respectively. These data allow for two conclusions. Firstly, PZU’s dominance continues. Secondly, the popularity of court restructuring proceedings in terms of the number of applications submitted and the number of restructurings opened is at constant levels. It should be mentioned, however, that there are large fluctuations in popularity within individual types of restructuring.

However, in the field of bankruptcy proceedings, in the analyzed period the data showed mixed results. The number of applications submitted in July (2,174) was the second highest result this year (only in March, 8.7% more applications were submitted), and the number of applications from August (1,878) was the lowest result (only in January, 5.5% more applications were submitted). fewer applications) this year. In terms of detailed data on the number of applications submitted by commercial law companies, it was noted that August received the largest number of applications this year (the number of applications was exceeded 200 for the first time). When looking for the reasons for this state of affairs, it is worth paying attention to the fact that the state of epidemic threat was lifted on July 1. Then came the end of the so-called bankruptcy moratorium introduced during the COVID-19 pandemic for entities that became insolvent as a result of the ongoing pandemic. It is worth adding that along with the increase in the number of applications submitted by commercial law companies in August, there was a simultaneous decrease in applications submitted by natural persons (there were the fewest in August) throughout all months this year. In turn, in terms of the number of resolutions declaring bankruptcy, the statement about the sinusoidal development of both the total number of resolutions and the number of resolutions regarding the bankruptcy of natural persons remains valid. The conclusion that the number of decisions declaring bankruptcy of commercial law companies remains at a similar level is also unchanged.

The study was prepared by: Ph.D Ulyana Zaremba and Ph.D Maria Wąsicka-Sroczyńska and and Legal Counsel Maciej Woźniak.

1 As in previous reports, we would like to remind you that the indicated number does not reflect all initiated proceedings for approval of the arrangement, but only those in which the debtor decided to use the protection provided by the announcement in the KRZ.

2 Data from January 2023 to which we refer are available at the link: https://orestrukturyzacji.pl/en/2023/02/28/restructuring-and-bankruptcy-proceedings-in-january-2023/, data from February 2023: https://orestrukturyzacji.pl/en/2023/03/24/restructuring-and-bankruptcy-proceedings-in-february-2023/, data from March: https://orestrukturyzacji.pl/en/2023/04/21/restructuring-and-bankruptcy-proceedings-in-march-2023-with-a-quarterly-summary/, data from April: https://orestrukturyzacji.pl/en/2023/05/29/restructuring-and-bankruptcy-proceedings-in-april-2023/, data from May: https://orestrukturyzacji.pl/en/2023/06/19/restructuring-and-bankruptcy-proceedings-in-may-2023/

3 By natural persons we invariably mean both applications submitted by consumers and by entrepreneurs running a business.